PulseX is a Uniswap v2 fork that will be deployed on the PulseChain network.

PulseChain is a fork of Ethereum with its full system state.

Launch date is this year, probably in the next 2-3 months.

To get your hands on PulseX before launch, you can sacrifice right now (details explained below or on pulsex.com)

Beginners Guide to Decentralised Exchanges

If you are a Crypto Pro and know what a DEX is, skip this section.

If you don’t know what Uniswap is, let me introduce you to the wonderful world of DEXs (Decentralised Exchanges).

A DEX is a smart contract (piece of code) hosted on the blockchain in contrast to CEX (Centralised Exchanges such as Coinbase, Binance, OkCoin, Huobi).

Prime examples are:

Uniswap v2, v3

Sushi Swap

dydx

Trader Joe (AVAX)

Pancake Swap (BSC)

Decentralised exchanges have more volume that the centralised ones and permit anyone to execute trades. This is one of the purest form of DeFi. There is no middleman, just the code. This also means that the fees can be a fraction of what it normally costs on CEXs. You will need to pay for gas though and currently that is quite prohibitive (40-100$ on Ethereum depending on gas price).

Exchange aggregators such as 1inch.io or matcha.xyz help you swap your coins across multiple exchanges so that you get the best price.

However, code can be messed with. While the above list exchanges are safe to use, as long as there are admin keys, the founders or someone else can change that code.

All in all however, they are permissionless and will continue to function until the blockchain does.

How do they work?

Classical order book based exchanges (legacy finance) need market makers to buy and sell to bridge the spread between bids and asks of the clients/users.

The innovation that made DEXs possible and functional was AMMs. AMMs aka automatic market makers that allow 24/7 trading between as many pairs as there is liquidity for on a network.

Glossary - Some Important terms

Liquidity is the existence of coins.

Liquidity pools (main AMM mechanic) are bags of coins put in balance with each other.

Liquidity Pools get liquidity from Liquidity Providers. They receive parts of the trading fee as reward for providing the liquidity.

Liquidity Providers can also experience losses. These are called impermanent losses. This happens when the prices of the coins in a liquidity pair diverge strongly.

Only becomes permanent (real) loss if price doesn’t rebound and I remove my liquidity

Everyone can be a Liquidity provider

Slippage: think of it as price variation from the moment you submit your order. More formally, The amount the price moves in a trading pair between when a transaction is submitted and when it is executed.

Price impact: The difference between the mid-price and the execution price of a trade.

A DEX Smart Contract needs a frontend so you can more easily interact with it. Otherwise we’d all have to “talk” to the blockchain ourselves.

Some DEX frontends show price impact and slippage additional to the transaction cost and fee

Some definitions from the Uniswap Glossary.

ETH / USDC Example

Uniswap v2 characteristics:

Uniswap v2 requires a 50%/50% split

Uniswap v3 allows different splits (1/3+2/3 or whatever you fancy)

Uniswap is a Constant Product Market Maker.

The invariant (thing that does not change) is X * Y = K.

X and Y are the quantity of the coins deposited in the liquidity pool

Uniswap can be used as a price Oracle, but that’s a discussion for another time.

Let’s look at a liquidity pool for trading ETH and USDC

Using Uniswap v2 we’ll need 1/2 ETH and 1/2 USDC. So let’s say that the price of ETH is 3800$. So let’s go with 10 ETH and 38000 USDC to set up a pool.

Now, let’s trade some USDC for ETH.

If someone wanted to extract 1 ETH they have to put in 10 * 38000 / 9 = 4222 USDC.

“Quantity of coins in the pool divided by the quantity that is left at the end of my swap”

These are the steps:

X * Y = K so 10 * 38,000 = 380,000 = K

K’ = K (needs to be equal to the new X’=9 ETH times a Y’ in USDC)

380,000 = 9 * Y

Y needs to be 42,222.222 USDC

I need to put in 42,222.222 - 38,000 = 4,222.222 USDC for 1 ETH

The pool has 1 ETH less but more dollars + the liquidity supplier got a trading fee of 0.3% of the trade.

This example extracted 10% of one side of the pool, so the price impact was rather large 3,800 initially vs 4,222 USDC/ETH.

Extracting only 0.1 ETH would have had a fraction of the price impact (1 ETH = 3,838USDC). So, the larger the pool compared to the trade, the less price impact. This is why AMMs such as Uniswap are quite costly for large trades.

tl;dr: The ratio of tokens in the pool, in combination with the constant product formula, ultimately determine the price that a swap executes at (from uniswap docs).

When you extract only a small percentage (of the liquidity) of coin X when you swap for coin Y, you can skip complicated calculations and just divide the quantity

There are many pools in DeFi and because one pool can show a different price arbitrage bots have been created by all sorts of coders to rebalance those pools and pocket the difference (also by buying and selling coins from CEXs).

Impermanent Loss

As a liquidity provider, from the swap I experienced something called impermament loss. Now, if I were to take out the tokens out of the liquidity pool I’d be left with a permanent loss in ETH tokens especially if the price moves further away and I can’t buy 1 ETH back with the 4,222 USDC + 0,3% trading fee.

I impermanently lost 1 ETH when the trade occurred. On paper I’m still constant in the product of tokens.

This is a reason why liquidity pools are mostly created for tokens that tend to move together.

But if I keep my liquidity, the price might move back. I could still have all my ETH, all my USDC + the trading fees.

If you want a deeper dive into the mathematics explained in a simple-ish manner, this is an amazing read.

Uniswap can be used as a price Oracle, but that’s a discussion for another time.

Another side note, sometimes you cannot find a pool to swap coin X for coin Y and you would have to go through multiple pools to get there X → Z → W → V → Y. This is called routing and can increase the swap costs and slippage by a lot.

Another example of how to implement AMMs are price curves (not explained here) eg. the Curve Protocol.

For a more in dept explanation I recommend the BTB defi substack or Google ;)

PulseX Game Mechanics

As promised, I’m going to look into the mechanics of PulseX and the Sacrifice phase. I’m going to focus on the main thread and give you the big picture. All the base info can be found on https://pulsex.com/

PulseX is both a token and the name of the Smart Contract that constitutes the DEX. It will have it’s own frontend and follow the rules of Uniswap v2 as outlined above (with minor but important changes).

PulseX main game mechanics:

Yet another DEX based on Uniswap v2

50%/50% split in the Pools

Constant Product Market Maker (X*Y=K)

Different fee structure

0.29% vs 0.3% (also different fee split)

PulseX governance token buy&burn from the swap fee of the DEX

Incentive token for incentivising liquidity providers to bridge in other tokens

DAO (PulseX token is also used for governance of the incentive token)

Liquidity harvester on PulseChain Launch will fill PulseX with most of the liquidity from Uniswap and SushiSwap

Why PulseX, why another DEX?

Why was PulseX created? Because of a game theoretical problem that arises from the PulseChain token inflation.

Some small details about PulseChain (will cover it in another article in more detail):

Copy of Ethereum (largest Airdrop in the history of crypto)

Full system state (airdrop) - all the tokens, smart contracts, balances

Switch network on MetaMask and your keys work for the copied tokens

ETH balances become PLS

Proof of Stake with stake delegation instead of PoW

1,000,000x increased native token supply compared to ETH (distributed to PulseChain sacrificers)

Basically a faster, cheaper ETH2.0

Liquidity Harvester

The million x increase in the native PLS token supply poses a problem as the 1:1 copy of the liquidity pools in quantity terms will remain the same. This would make the PRC20 (the ERC20 equivalent) have a value 10^6 times lower compared to PLS.

Let’s look at the ETH/USDT pool:

This pool will be copied 1:1 on the date of the snapshot. It will become WPLS / pUSDT.

Because the blockchain is immutable, the plan of the harvester bot is to inject 1000x liquidity on the ETH (PLS) side and extract the coins on the other side.

The bot will come in and inject 1000 times more WPLS and extract pUSDT until the X * Y = K holds again.

Calculation:

Inject PLS to 1000x one side. Instead of 33,829 there will be 33,829,000 wPLS

Apply the AMM formula:

33,829 * 107,422,593 / 33,829,000 = 107,422 pUSDT

so the bot injects 33,829,000 - 33,829 = 33,795,171 wPLS

and extracts 107,422,593 - 107,422 = 107,315,171 pUSDT

only 107,422 * 100 / 107,422,593 = 0.0999% left of the other token in the pool

Basically pumping 1000x the token amount for the PLS side and extracting more than 99% of the other token (~1000x reduction in number). 1000 * 1000 = 1 million times liquidity rebalancing.

This will keep the same ratio of the native PLS token to the pUSDT token like on the Ethereum network (accounting for the PLS inflation).

So if the harvester bot harvests 99% of all liquidity pools and rebuilds them in PulseX it is going to be a huge (probably the biggest ever) vampire attack.

If you provide liquidity you can guard against this by removing the liquidity during the snapshot phase (will be announced before PulseChain launch).

Of course this could end up pretty good for the LPs because they will receive more PLS tokens for their copied PRC20 tokens. As PLS the native token might appreciate far more than the PRC20 tokens.

However! If the LPs value their PRC20 tokens they might want to get them back. So they would spend some coins to get some of their more valuable coins back (PLS, bridged in tokens, other PRC20s). This is just another case where crazy stuff could happen. Think about someone wanting more $MANA for their Decentraland gaming on PulseChain. (this was pointed out to me on twitter by @CortaPanda - there’s layers to this game theory)

PulseX Fees

The most notable change compared to Uniswap v2 is the activation of the protocol fee switch (Uniswap v2 still has this deactivated). That is a mechanism that redirects parts of the fees to another entity (DAO, founders, 0x0 address etc.). For example, if Uniswap activated it on ETH, they could buy back UNI tokens with those fees thus adding buying pressure to it.

That’s exactly what PulseX will do in order to create value for the PulseX token.

Uniswap fee structure:

Users pay 0.3% fee whenever they swap their tokens through Uniswap. Uniswap V2 has a protocol fee switch that can redirect 0.05% of 0.3% fees accumulated to other venues that Uniswap Governance see fit. So, the fees can be separated into two baskets: 0.25% goes to Liquidity Providers (LP) + 0.05% controlled by Uniswap Governance which is currently also directed to LPs.

PulseX fee structure:

PulseX will have a 0.29% fee that users pay on every swap. That is less than Sushiswap, Trader Joes, Quickswap and Uniswap. 76% of all trading fees could be distributed to Liquidity Providers. 21% could be used to buy and burn PLSX, reducing its supply over time. 0.01% of a trade's value goes to an address you must have no expectations of.

Note: In RH’s crypto ecosystem there is lots of talk about the OA (Origin Address) and other addresses (such as this 0.01% destination address) that you should have no expectations of. I would argue that these are similar to “dev team” addresses or “founder addresses”. I’m telling you this for full transparency. I’d rather have RH or Elon control their ventures that someone else (or even DAOs for that matter).

The differing fee structure mean different incentives for the liquidity providers:

LP will earn 24% less fees on PulseX compared to Uniswap

The biggest volume will be on PulseX (99% of it)

PulseX holders will experience price appreciation due to buy&burn

Users will be incentivised to use PulseX because it is bigger and has less fees

Let’s see how many fees could be collected

SushiSwap daily volume $545,194,275.00

Uniswap v2 daily volume $581,615,966.64

Uniswap v3 daily volume $1,910,190,209.00

because 99% of the liquidity will be harvested and inserted into PulseX we could do a calculation for potential fees of PulseX and how much PulseX will be burned daily:

Fees generated: ($545,194,275.00 + $581,615,966.64 + $1,910,190,209.00) * 0.99 * 0.0029

= $8,719,228.29379

21% of the fees used for PulseX buy&burn: $8,719,228.29379 * 0.21

= $1,831,037.9417

So roughly a 2 million $ burn per day from ~9mil in fees. Assuming that the total value traded on PulseX will be the same dollar value as on Ethereum. This of course won’t be the case (yet?) but could change in the future after the price discovery.

Also, keep in mind that PulseX will not be inflated like UNI is. Only sacrificers will own PulseX and that will be the max supply (deflationary).

Possible Price Action

The above means that there will always be demand for the PulseX token. And because it is deflationary, this almost guarantees number go up (remember that UNI is inflationary).

I think the lower bound will be the UNI price chart (~17x). After all, UNI has no other utility rather than potentially governance and the future activation of the protocol fee to rebuy and burn the UNI token. Both are not used at the moment. PulseX will make use of those mechanism and amplify that by the much higher liquidity (~5-10x more liquidity).

UNI token chart:

Because the value of the token starts at 0 but people who sacrificed actually got it airdropped for about 0.0001$ we may see even higher returns.

The sacrifice could be a >20x based on the price evolution of Uni and the fact that there are other beneficial mechanics at play.

Of course this is all in PLS term on the PLS network. It will remain to see how much value the network will accrue.

PulseX Sacrifice Phase

How to get my hands on PulseX you ask?

Sacrifice!

That’s it. This and trading when PulseChain launches will be the only source of PulseX.

Why?

Because the token is deflationary! The Sacrifice sum determines how much PulseX will be minted on PulseChain launch and after that there will be no more issuance.

Ok, so what is a sacrifice?

A sacrifice means just that, a sacrifice of something of value for nothing in return.

PLEASE, PLEASE BE AWARE OF SCAMMERS

got to the official twitter https://twitter.com/RichardHeartWin

got to the official site /https://pulsex.com/

never give away your secret phrase, never screen share, don’t click weird links!

So the way it works is as such:

You go to pulsex.info (dApp) and choose to sacrifice ETH, Hex, ZCash, Doge whatever

Let’s say you choose ETH

You get shown an address

You send 1 ETH to that address and it’s gone

BUT! You have just made 2 things:

Show that you support freedom of movement and freedom of association

You have entered the set of people who will be airdropped the PulseX token

How much will I receive?

Depends on how much you sacrifice. You get 10,000 points for 1$ sacrificed. 1 point will get you 1 PulseX sacrificed.

So in the example above that will be the price of ETH at time of sacrifice, let’s say 3800USD * 10,000 = 38,000,000 PulseX

This is not a fixed number. There are volume bonuses and time penalties that apply.

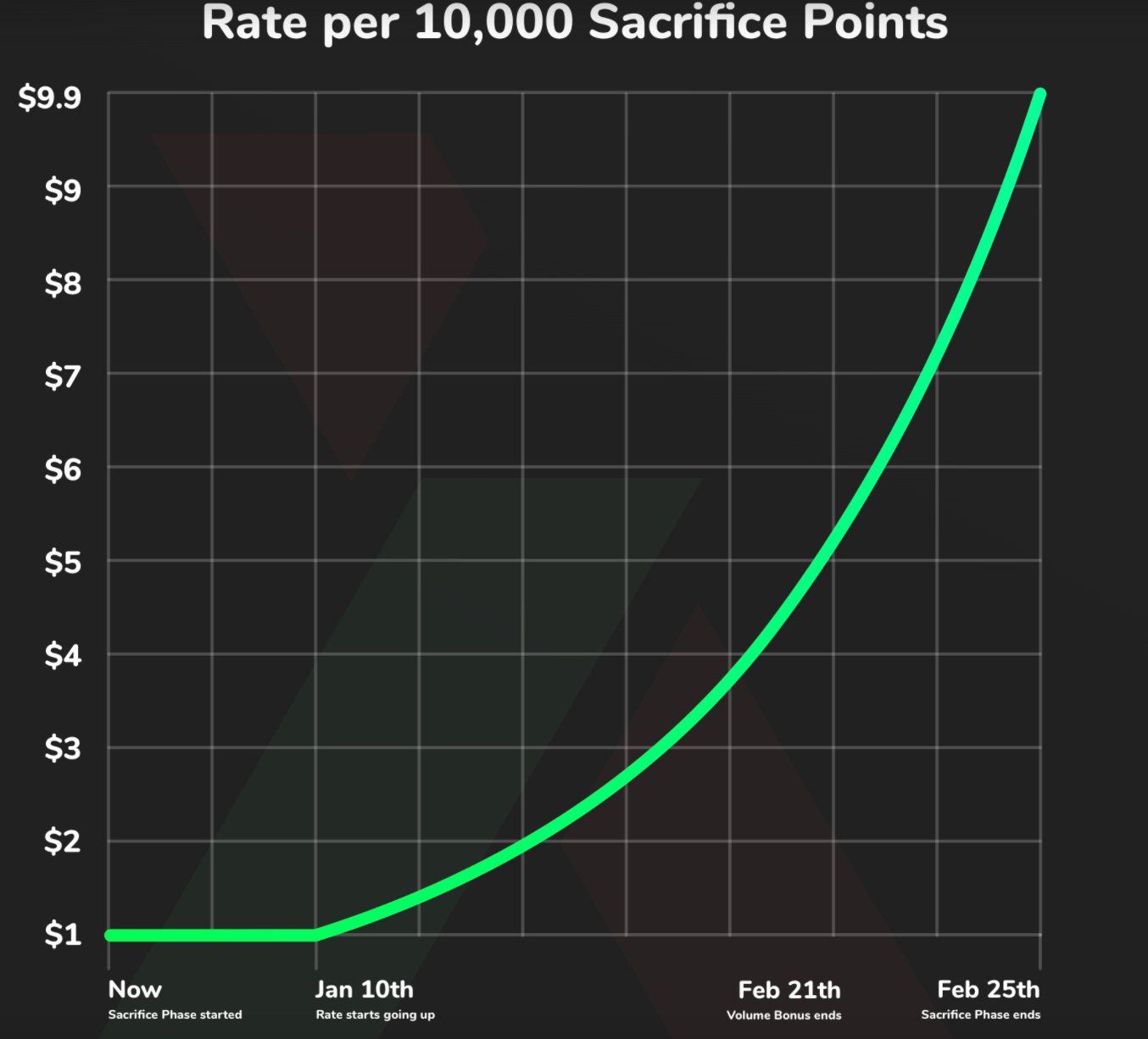

The important thing to know is that you will get the best sacrifice rate until the 10th of January 2022. After that, every day incurs a 5% penalty.

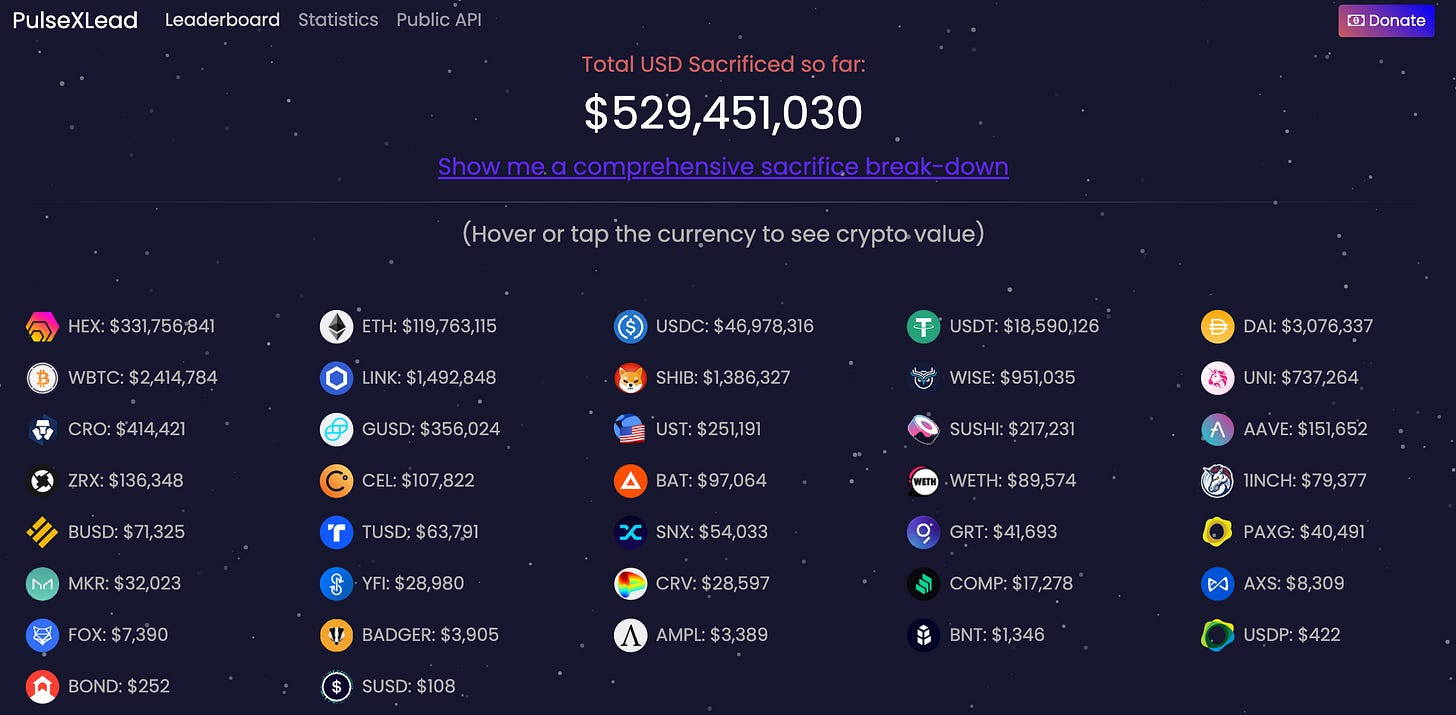

The volume bonus can get you up to 2.5x on the sacrificed sum. However, given that half a billion ! have already sacrificed, smaller investors will probably not get any volume bonus (or maybe a 10% if above $5000).

Follow the sums sacrificed and the sacrificer leaderboard at pulsexlead.xyz

I found your article very helpful. Beautifully articulated. I have a really important question that I can’t seem to get answered. There are rumors out that pulseX sacrificers will have the opportunity to swap pulseX (at a currently unknown exchange rate) 24-48 hours prior to pulsechain launch. Is this true? Any information you have on this would be greatly appreciated

Awesome article! The only thing not 100% clear (in your example) is the resulting balances of the pair in the PulseX pool. I'm guessing on one side it'll be the 107,315,171 pUSDT extracted, and on the PLS side it'll just get some kind of matching amount?